RBL Bank RTGS Form | RBL Bank NEFT Form 2024 PDF Download. How to fill, timings & charges for RTGS NEFT application form. Check the Article to know more about the RBL bank RTGS / NEFT transaction form.

RBL Bank RTGS FORM

Real-Time Gross Settlement is useful to transfer the amount of more than 2 Lakhs. Through the RTGS the person can send the funds to any bank in India. Each and every single transaction will be recorded in the books of the Reserve Bank of India(RBI). RTGS enables an efficient, secure, economical, and reliable system of transfer of funds from bank to bank.

RBL Bank NEFT FORM

National Electronic Fund Transfer is useful to transfer the amount less than 2 lakhs. Currently, all banks are using the NEFT facility to transfer funds between one bank account to another bank’s account. With this facility, funds can be transferred in some minutes. NEFT can be done online and offline.

What is the difference between the RBL RTGS and NEFT forms?

The same form can be useful for both RTGS / NEFT transactions. You can download the application form in this article.

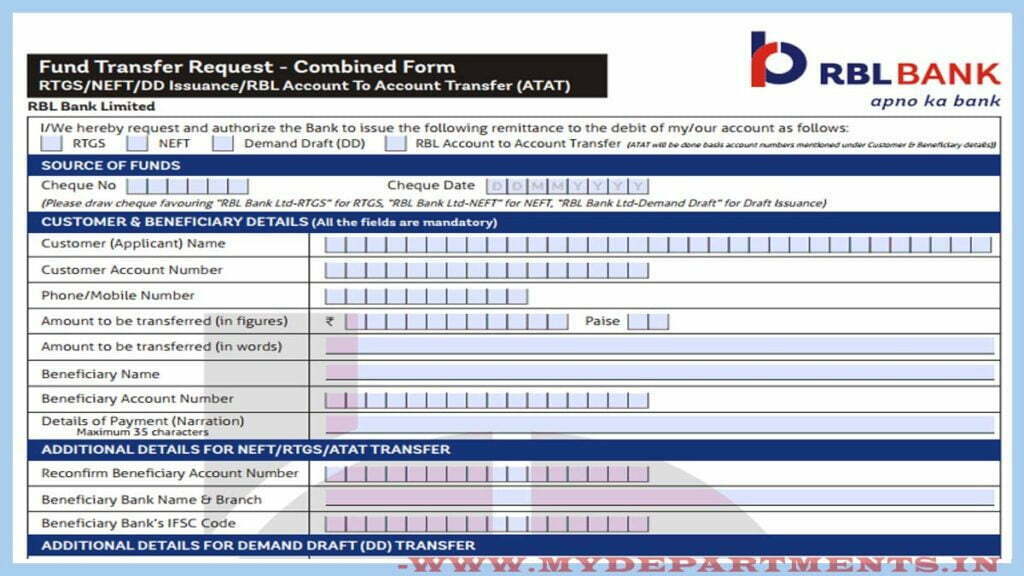

How to Fill RBL Bank RTGS / NEFT Application Form

The application form will have more blocks. You need to follow the following steps to fill RBL RTGS NEFT form without facing any issues.

Customer Details

- Customer (Applicant) Name

- Account Number

- Phone/Mobile Number

- Cheque, Date, No

Beneficiary Details

- Beneficiary Name

- Account type

- Account Number

- Address

- Bank Name and Branch

- IFSC Code

- Amount in words and Figures

- Mobile No

- Details of Payment

Customer Acknowledgement

- cash/ Cheque No

- Credited to Account Number

- IFSC Code

- UTR NO

- Sign

How to Download RBL Bank RTGS NEFT Form PDF

Customers can download NEFT RTGS fillable application form. Take a photocopy of the form. Fill the form as we discussed earlier. Now, Click on the below button to download.

Download Here.

RBL Bank Timings

Times to make RBL bank RTGS transactions are mentioned below. Anyway, RBL bank Real-Time Gross Settlement can be made online also 24*7. The timings are mentioned below is to make transactions in the bank branch.

| Banking Days | Timings |

|---|---|

| RBL RTGS on working weekdays (From Monday to Friday) | 10:00 AM to 3:30 PM |

| RBL RTGS on working Saturdays (Except 2nd and 4th) | 10:00 AM to 3:30 PM |

| RBL RTGS on Sundays and National Holidays | Transactions cannot be done |

RBL Bank NEFT Transactions can make online and offline. In the Bank, customers can make NEFT during bank Workings hours. The timings are mentioned below to make transactions in the branch.

| Banking Days | Timings |

|---|---|

| RBL RTGS on working weekdays (From Monday to Friday) | 10:00 AM to 4:30 PM |

| RBL RTGS on working Saturdays (Except 2nd and $th) | 10:00 AM to 4:30 PM |

| RBL RTGS on Sundays and National Holidays | Transactions cannot be done |

NEFT & RTGS Charges

RTGS is useful to transfer large amounts. There are no charges for RTGS transactions made online. The transaction service charges are mentioned below for the RBL RTGS made in bank branches.

| RTGS Amount | Transactions Service Charges (Rs) |

|---|---|

| 2 Lakhs to 5 Lakhs | 25/- (Exclusive of Taxes) |

| Above 2 lakhs | 50/- (Exclusive of taxes) |

NEFT transactions are useful to make payments up to 2 Lakhs. Different charges scales are presently based on the amount. There are no charges for applying on NEFT transactions made Online. The transaction service charges for NEFT done through bank branches are given below.

| NEFT Amount | Transactions Service Charges(Rs) |

|---|---|

| Up to Rs 10,000 | 2.50 + Applicable GST |

| Rs 10,000 to Rs 1,00,000 | 5.00 + Applicable GST |

| Rs 1,00,000 to Rs2,00,000 | 15.00 + Applicable GST |

| Above 2,00,000 | 25.00 + Applicable GST |

Frequently Asked Questions (FAQ)

Is a PAN card required for RTGS?

PAN card is mandatory for each and every transaction of more than Rs 2.5 lakhs.

Can RBL RTGS be done without Cheque?

RTGS transactions are available on all days 24*7 basically. There is the real-time transfer of money to the beneficiary account. The remitter need not use any kind of physical cheque.

Can I transfer 1 crore through RTGS?

YES, you can transfer or deposit 1 Crore through the RTGS system. The one to whom the money is transferred gets in by 30 minutes to credit it to their account.

What is an abbreviation for RBL bank?

The abbreviation/acronym for RBL bank is “The Ratnakar Bank Limited”.

For any more information. Visit RBL’s official website www.rblbank.com. Comment below for your queries.