Allahabad Bank RTGS Form 2021 PDF Download| Allahabad Bank NEFT Form

Allahabad Bank RTGS Form 2021

Today, we are going to see how to download Allahabad Bank RTGS NEFT form pdf. Know about how to fill, timings, charges, and benefits of Allahabad Bank NEFT / RTGS form. Most of the public and private sector banks in India are permitting for the RTGS / NEFT transactions. RTGS and NEFT can be done online and offline also. The Allahabad bank has a common format for both RTGS/NEFT across all the branches to keep it simple and process the same.

Allahabad Bank RTGS NEFT Form

Allahabad Bank RTGS/NEFT form is available both in English and Hindi and the local branches might even have their own regional language to make the process easy and like anyone access and pay the amount.

What is Allahabad Bank RTGS Form ?

Real-Time Gross Settlement(RTGS) is a high-end money transfer mode from one bank to another bank account. Users who want to transfer the amount of more than 2 lakhs can use this process. According to RBI, the amount must be deposited in the beneficiary bank account within 30 minutes by the sender bank if the transactions failed the amount must be returned within 2 hours.

What is Allahabad Bank NEFT Form ?

Allahabad Bank is one of the National Electronic Fund Transfer(NEFT) enables banks of the country. Account holders who wish to make fund transfer using NEFT can download Allahabad Bank NEFT form online or visit the branch and make the payment.

How to fill Allahabad Bank RTGS/NEFT form in Offline ?

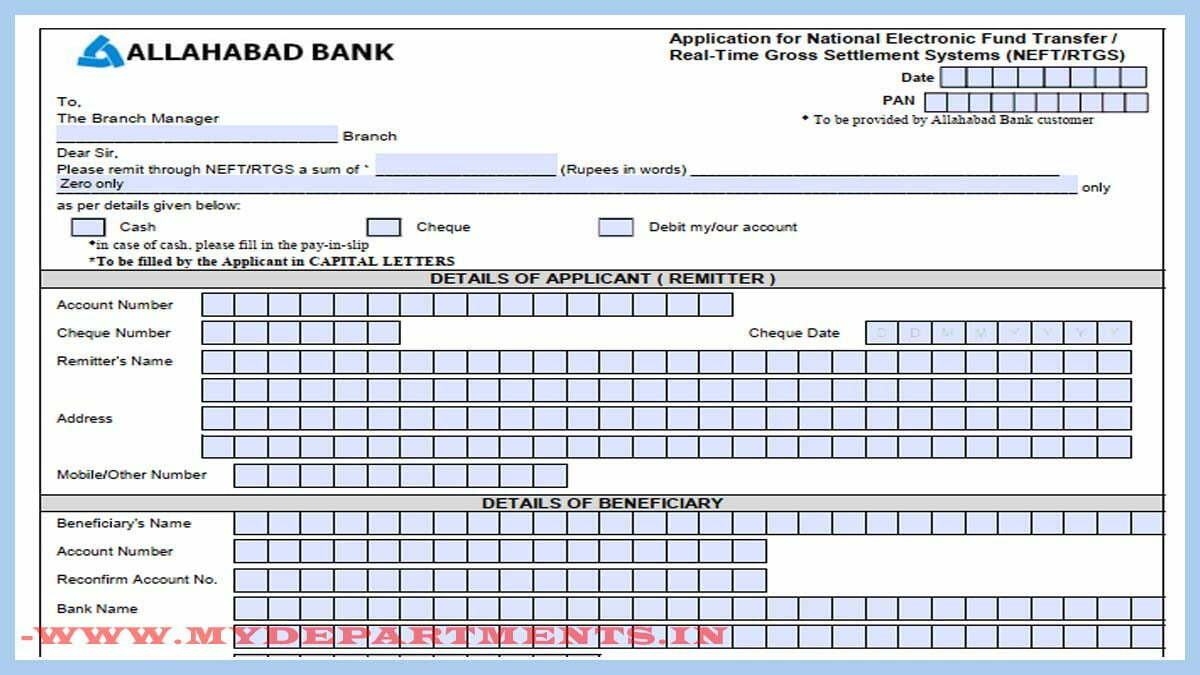

By seeing the Application form, we can notice that there are 3 blocks. The 1st block is for the Branch Manager, the 2nd block is details of Applicant, 3rd block is details of Beneficiary.

Lets us see step by step:

The First block is about the payment Information: This block includes the details regarding the bank branch.

- Fill the Branch Name

- Cheque number if the amount is paid through cheque.

- Select the option cash, cheque, debit form account.

The second block is details of the applicant (Remitter): This block included the details of the remitter.

- Account Number

- Cheque Number, Cheque date

- Remitter’s Name

- Address

- Mobile Number

The third block is about details of the beneficiary: This block included the details of the beneficiary.

- Beneficiary’s Name

- Account Number

- Reconfirm Account No

- Bank Name

- IFSC Code

- Branch Address

- Sender to Receiver information.

Allahabad Bank RTGS NEFT PDF Form

Customers of Allahabad bank can download application form. For NEFT / RTGS transaction easily in this webpage. Download Link.

How to find Allahabad Bank RTGS/NEFT form in online ?

Allahabad Bank is providing as the online RTGS/NEFT transaction through online pdf file format Net banking or mobile banking. The customer should fill all the details.

- Name of the beneficiary

- Account Number of the beneficiary

- Account type of the beneficiary

- IFSC Code of the beneficiary

- Choose the option RTGS or NEFT funds transfer method.

Charges for RTGS Transaction

Charges on the online have been removed by the Reserve Bank of India(RBI) to support banking service.

| Transaction Amount | Transaction Service Charge |

| Rs 2,00,000/- to 5,00,000/- | Rs 24.50 (Exclusive of tax) |

| Above 5,00,000/- | Rs 49.50 (Exclusive of tax) |

Charges for NEFT Transaction

There is no Service charges will be applied on NEFT transactions through online.

| Transaction Amount Limit | Transaction Service Charge |

| Up to Rs 10,000/- | Rs 2.50 (Exclusive of tax) |

| From Rs 10,001/- to 1,00,000/- | Rs 5.00 (Exclusive of tax) |

| From Rs 1,00,001/- to 2,00,000/- | Rs 15.00 (Exclusive of tax) |

| Above 2,00,000/- | Rs 25.00 (Exclusive of tax) |

Timings for RTGS in Allahabad bank

| Days | Timings |

| Weekdays | 8 AM to 4:30 PM |

| 1st,3rd,5th Saturdays (2nd and 4th Saturday is holidays ) | 8 AM to 4:30 PM |

NEFT Timings in Allahabad Bank

| Days | Timings |

| Weekdays | 8 AM to 7 PM |

| 1st,3rd, and 5th Saturdays (2nd and 4th Saturdays is holidays) | 8 Am to 7 PM |

Benefits of RTGS Service

- Save time.

- Same paper without any need for physical documentation.

- There is no threat of money being stolen.

- Huge money can be transferred easily.

Benefits of NEFT Service

- NEFT is simple and effective it can be done in minutes.

- Confirmation of successful transactions can be easily received through Email and SMS.

- Internet banking can be done in any place.

- Real-time transactions assure both from the receiver and sender.

For any more information. Visit the Allahabad Bank official website.

Frequently asked questions

What is the maximum time for NEFT transaction?

Neft transaction will process in batches at 30 minutes time intervals. The maximum timings for the settlement in the bank batches is 2 hours (subject to cut-off timings and batches)

What is faster NEFT or RTGS?

Generally, RTGS transactions will process in real-time. Means as soon as the request raised from the bank. NEFT transactions will process in batches at regular intervals. RTGS transactions will mostly faster than NEFT.

What is the details required for a NEFT transfer?

Few most important details for NEFT transaction. Like name of the payee, beneficiary account number, IFSC code, bank branch, phone number.

Can I transfer 1 Crore through RTGS?

YES, we can transfer 1 crore through RTGS. RTGS is useful for transfer high-value transactions. The minimum transaction limit is 2 lakhs. There is no maximum limit for RTGS.